/1/22 · Manual historical backtesting There is no need to code the strategy to do an initial validation test. All we have to do is pick a chart, go back in time and start performing trades manually. But how to do it properly? Use a trading log spreadsheet, as the one forex Benefits of manual backtesting: Trading strategy experience Visual recognition A better experience with market behavior In general, a lot of “seen graphs” and experience With backtesting, it is the experience with the trading strategy, its easy visual identificationEstimated Reading Time: 4 mins Forex Manual Backtest – Backtesting Report and Using Excel. In this article, we are going to see what information we need to collect for a manual backtest, particularly in forex; how to gather them, what can be found in a backtesting report and what do they tell us and how we can calculate the information we’ve gathered using blogger.comted Reading Time: 8 mins

How to Manually Backtest a Trading Strategy on MT4 and MT5

Heads up! There is a free version that you can use to follow this guide. However, manually backtesting your strategy forex, if you purchase the full version through our link, we get manually backtesting your strategy forex small commission.

This comes at no additional cost to you, manually backtesting your strategy forex. This is a huge manually backtesting your strategy forex it just might be enough to prevent you from being profitable.

Backtesting in forex is the process of assessing your trading strategy by seeing how it would play out in the past. You do this by executing your strategy in a simulated market environment that uses historical market data.

Forex backtesting shows you the validity of your strategy and gives you the information you need to make it better. Even more importantly, manually backtesting your strategy forex, it helps you understand your strategy and what you can expect from it.

The latter is crucial because no matter how awesome an analyst you become, you will never be able to anticipate the future with certainty. However, if you know what you can expect in the long run in terms of wins, losses, time commitment, etc. Before you can manually backtesting your strategy forex trading your strategy on past market data, you must do a few things to prepare yourself for backtesting. If you want to backtest on a Mac computer, consider installing Windows in a VirtualBox.

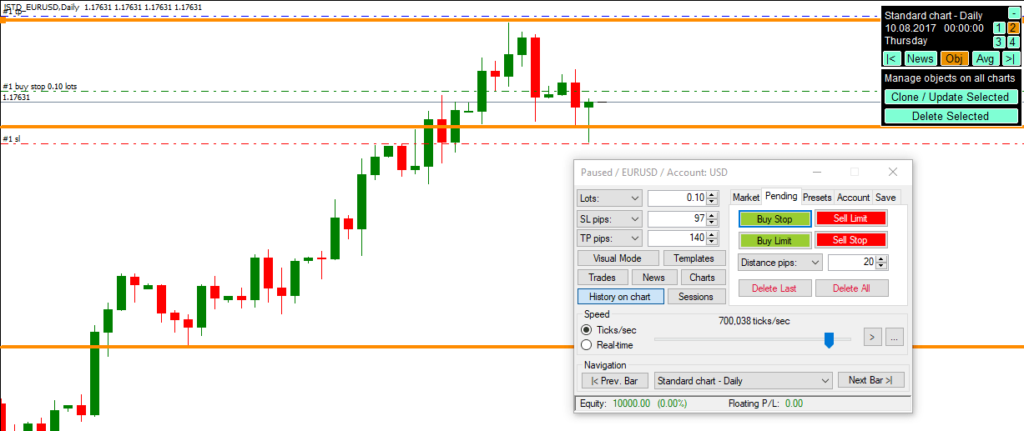

The second step is to download MetaTrader 4. You can do that here for free. Soft4FX is not a standalone software, but an expert advisor for MetaTrader 4. It has its own interface, manually backtesting your strategy forex, but it relies on MetaTrader for key functionalities such as charting tools, sound effects, and other design elements. However, the demo version is just fine for following along with this guide, and you can decide on the purchase later.

Once you have Soft4FX in the MT4 data folder, you will need to restart the terminal. Double click to launch and a window will appear. You must navigate to the inputs section to enter your email and activation code.

Most backtesting projects start with some initial planning. This means setting up a paper trading account and deciding on the key parameters of the simulation. You can download data with a few clicks from the Soft4FX data center without leaving your MT4 terminal. For example, we backtest on three years of market data using the daily chart.

If you want to test your strategy on more currency pairs, you will have to run separate simulations for each pair. You can then summarize the results to see your overall performance. To set the general parameters of your simulated trading account, you will need to adjust the main settings. You can decide when to start the simulation and whether you want to automatically end it at a certain date or continue until the last data manually backtesting your strategy forex. You can choose only between the two currencies you test.

Nevertheless, for the starting balance, it makes sense to use a balance that you could deposit in real cash. You want to imitate real-life conditions as closely as possible and your account size influences things like position sizing and risk management. As the last setting, you can decide whether you want to allow rewinding. We initially disabled this option, but after hours of backtesting, we got tired and missed some great opportunities that we would certainly have recognized in a live trading situation.

So, if you can use it manually backtesting your strategy forex, we recommend that you allow rewinding, manually backtesting your strategy forex, as it enables you to move back a few candles whenever you clicked too fast and ignored a trading opportunity.

To begin, you can change the pip size and the size of one contract. As a general guideline, most EU traders can access leverage of for forex, manually backtesting your strategy forex, while traders in the US have a slightly higher limit of Spreads are typically variable unless you have some specific account type.

For example, some brokers provide accounts with zero spreads and a fixed commission per lot traded. Before starting the simulation, you have the option to set the initial history on the charts.

This might come in handy if you want to plot support and resistance levels or do some preliminary analysis. You can also decide on the number of bars the chart can keep. Feel free to change the colors and add any indicators you need. If you work with more charts, you might want to create a custom template so that you can apply it to other charts with a click.

Make sure the custom template is created on a chart other than what is opened for the simulation. Otherwise, if you create a custom template on a simulated chart, the Soft4FX toolkit at the top-right corner will be included in the template. Once you finish setting up your charts, you can begin the market simulation. For market orders, this is all you need.

You can click buy or sell and the trade will be executed. For pending orders, however, you must also define the distance in pips. From having made a mistake to wanting to move your stops into breakeven or adjusting the profit target, there could be numerous reasons why you find yourself facing this issue.

This brings up a window that shows your market and pending orders. You can also check some statistics here, but we will get into that later. Depending on your trade, a few lines will appear on the chart representing your TP, SL, and entry level for pending orders. You can manually drag each line and move it wherever you want.

The risk-to-reward ratio will be calculated in real-time, as will the dollar amounts. Most traders who use this technique monitor three different timeframes, such as the daily, four-hour, and hourly. The analysis is done from top to bottom, with trades being opened on the smallest TF. Make sure you open the charts and navigate to the highest timeframe. If your method also involves scaling in that is, you divide your risks into smaller position sizes and enter at different price levelsyou can scale out simply manually backtesting your strategy forex systematically closing your trades.

However, if you use scaling as an exit-only tactic, you will need to know how to make partial position closes. A partial position close means that you close only a certain portion of your position and let the other run. You can either enter a lot amount or choose which percentage of the position you want to get rid of.

Whether you want to avoid trading around the news or take advantage of it, Soft4FX has you covered. Then you can exit the window. For upcoming news, there will be a red dotted line, manually backtesting your strategy forex, while for news that has already passed, there will be a grey dotted line.

You can also follow your statistics in real-time during backtesting. The manually backtesting your strategy forex drawdown is calculated for equity, meaning it considers your account balance plus the value of floating positions.

This is in contrast to the absolute drawdown, which shows how much the balance has decreased in relation to the initial deposit. Looking at only this number is misleading because, in reality, you experienced a much more severe losing period, as shown by the manually backtesting your strategy forex drawdown, which would have been To conclude, we recommend that you focus on the maximal drawdown when evaluating your performance, manually backtesting your strategy forex.

Every trader experiences drawdowns, but successful traders can withstand these losing periods both mentally and financially. If your drawdown is too high, consider risking less of your account per trade. ForexTrainingGroup has a great guide on the topic of drawdowns if you are more interested. A trade that takes you less than a minute to finish during backtesting might take weeks or months in reality.

To get the number of days, weeks or years between two dates, use the DATEDIF function. You can automatically fill the formula to the other cells by simply selecting the cell that has the formula, resting your cursor in the lower-right corner and dragging the fill handle down. If you happen to have these empty values like we have, sorting the list by ascending order will do the trick.

Finnaly, you can summarize the values using the SUM function and divide by the number of trades which is shown on the backtesting statement. Both winning and losing streaks happen quite often, and while nobody complains about extended winning streaks, most people become worried when they run into a few losses in a row.

If you know that your otherwise profitable strategy will eventually produce, say, eight losing trades in succession, you manually backtesting your strategy forex be less stressed after the fifth losing trade. The less uncertainty you face, the more likely you are to retain your objectivity and avoid the emotional pitfalls of trading.

Backtesting is essential. This will help you grow as a trader and eventually make money. This is a complete guide to forex backtesting in Source: BabyPips. How Much Do You Need to Start Trading Forex?

Avoid Illusions. Want the inside scoop? JOIN THE COMMUNITY. Subscribe to get Forex education materials delivered to your inbox once a week. Send me great stuff Join the Community By subscribing we will send you education emails about Forex trading. Please select all the other ways you would like to hear about us: Yes please, send me updates, eg. new blog posts. Yes please, send me offers about trading related products and services.

We won't send you spam. Unsubscribe at any time. Legal Terms and Conditions Privacy and Cookie Policy Cookie Declaration Page. Trading FX or CFDs on leverage is high risk and your losses could exceed deposits.

How To Backtest Strategies Manually On MT4

, time: 14:21Forex Backtesting: The A-Z Guide to Backtesting Your Strategy

Benefits of manual backtesting: Trading strategy experience Visual recognition A better experience with market behavior In general, a lot of “seen graphs” and experience With backtesting, it is the experience with the trading strategy, its easy visual identificationEstimated Reading Time: 4 mins Forex Manual Backtest – Backtesting Report and Using Excel. In this article, we are going to see what information we need to collect for a manual backtest, particularly in forex; how to gather them, what can be found in a backtesting report and what do they tell us and how we can calculate the information we’ve gathered using blogger.comted Reading Time: 8 mins /11/22 · Manual back-testing simulates the live environment using past data and performance, this can enhance your trading and increase your probability for success. News & Analysis at your Estimated Reading Time: 5 mins

No comments:

Post a Comment