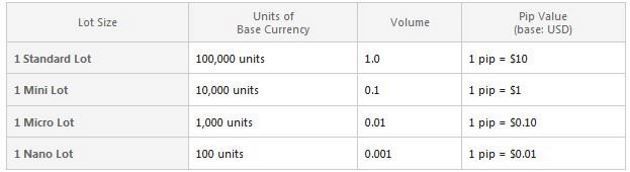

pairs (JPY pairs: the 2nd decimal point is the pip) Spread: difference in the price of buying and selling a currency pair (similar to bid and ask difference in stock trading) Lot size: number of currency pair units being traded. Typical size of lot: Standard: , contracts 75 rows · The pip value in Monetary value is crucial for Forex Traders as this helps to analyze and 72 rows · on the size of the contract (i.e. the number of units of a currency pair) the definition of the pip, which is not always the same depending on the pair selected (e.g. the pip for the EUR/USD = , the pip for the EUR/JPY = ) The exact formula is the following: z pip XXX/YYY =z* S * dPIP expressed in currency YYY

Forex Pip Values - Everything You Need to Know - Forex Training Group

Crude oil represents a naturally, fossil, unrefined petroleum product composed of hydrocarbon deposits and other organic materials.

Crude oil can be refined to produce usable products such as gasoline, diesel, and various other petrochemicals. The most famous types of crude oils are WTI Crude Oil and Brent Crude Oil.

The difference between Brent crude and WTI crude oil is that WTI originates from U. oil fields, forex pairs pip size, and Brent Crude originates from oil fields in the North Sea.

WTI or the West Texas Intermediate is a grade or a mix of crude oil. Its spot and futures prices are used as a benchmark in oil pricing, forex pairs pip size. Its grade is referred to as light crude oil due to a relatively low density. The presence of sulfur makes it the sweetest. It refers to the price of the New YorkMercentile Exchange WTI Crude Oil futures.

There are various ways crude oil can be traded; our focus will forex pairs pip size on retail forex trading platforms for this instrument, forex pairs pip size. The smallest price change for Crude Oil is 0.

So when the price rises from If we buy 1 micro lot from If we buy 1 mini lot from If we buy 1 lot from Many brokers give you leverage on this instrument, forex pairs pip size. This is what you need to open a 10 barrel position. Other than the capital required to open a position, it would help if you also had marginal capital to support any floating losses. You will lose 5 pips as soon as you open a position as it is its spread. The leverage offered by brokers is not always this high.

Some brokers offer leverage as low as In such cases, you will need a larger capital to open a position and support floating losses. A pip denotes the smallest change in the price of an instrument. It helps in identifying how an instrument in the market has witnessed much fluctuation. This principle will help traders to learn how to trade crude oil in the forex MetaTrader platform. The trader bought 1 lot at In this example, the trader generated 45 pips profit.

This oil pip value is stationery as the U. dollar is the quote forex pairs pip size counter currency in the crude oil and U. dollar pair. The easiest and way to find out your profit is by using a simple arithmetic equation:. The oil price is a crucial fundamental factor that can manipulate the value of a currency, forex pairs pip size, especially if the country is a major exporter or producer of oil and oil products. For example, Canada exports a major part of its petroleum products to the U.

the Canadian dollar CAD enjoys a stronger position when the traded oil prices are on a higher side. Other currencies correlated to the trading oil prices are the Danish Krone DKK and the Norwegian Krone NOK. Like any commodity, the oil price also fluctuates, forex pairs pip size. The rate of consumption and production are two events that affect it. For example, a declaration made by the United States, stating that a considerable amount of energy has been drawn from their reserves, proves that there has been an increase in the consumption of oil.

Since the demand has certainly increased, the prices will likely increase as well. This can be avoided only if the subsequent supply also increases. The oil prices will drop if the demand declines or the supply overpowers it. The prices can spike rapidly if the Petroleum Exporting Countries OPEC Organization decides to reduce forex pairs pip size. This is because investors will buy forex pairs pip size in huge numbers to profit from it, leading to a further decrease in its supply.

War in the oil-producing country, delay in oil shipments for reasons like bad weather, damage to oil pipelines, forex pairs pip size, a change in USD and other currencies, technology are a few more factors that affect the oil price. The list is not limited to these factors. Home Choose a broker Brokers Rating PAMM Investment Affiliate Contact About us. What is Crude Oil? WTI Crude Oil WTI or the West Texas Intermediate is a grade or a mix of crude oil.

Let us see how we forex pairs pip size calculate oil in the WTI forex platform Metatrader. Lot Size of Crude Oil — oil pips in MetaTrader The smallest price change for Crude Oil is 0. Pip Value of Crude Oil A pip denotes the smallest change in the price of an instrument. Crude Oil and Related Instruments The oil price is a crucial fundamental factor that can manipulate the value of a currency, especially if the country is a major exporter or producer of oil and oil products.

What Affects Oil Price? Author Recent Posts. Trader since Currently work for several prop trading companies. Latest posts by Fxigor see all. The Best 4h Forex Strategy Will Interest Rates Go Up in ? Silver Price History — Price of Silver Over Time. Related posts: How to Calculate Pips on Silver? How to Read Pips on Gold? How Many Pips Does Gold Move in a Day? How to Calculate Lot Size in Forex? How to Get More Pips in Forex Trading? USDJPY Pip Count — How to Calculate JPY Lot Size? How Many Pips Does Eurusd Move Daily How to Calculate Risk Reward Ratio in Forex How to Read Candlesticks?

Trade gold and silver. Visit the broker's page and start trading high liquidity spot metals - the most traded instruments in the world.

Main Forex Info Forex Calendar Forex Holidays Calendar — Holidays Around the World Non-Farm Payroll Dates Key Economic Indicators For a Country The Best Forex Brokers Ratings List Top Forex brokers by Alexa Traffic Rank Free Forex Forex pairs pip size Without Deposit in Brokers That Accept PayPal Deposits What is PAMM in Forex? Are PAMM Accounts Safe? Stock Exchange Trading Hours. Main navigation: Home About us Forex brokers reviews MT4 EA Education Privacy Policy Risk Disclaimer Contact us.

Forex social network RSS Twitter FxIgor Youtube Channel Sign Up. Get newsletter. Spanish language — Hindi Language.

Pip Value: What it is and how to calculate it

, time: 3:00Pip Calculator | Myfxbook

75 rows · The pip value in Monetary value is crucial for Forex Traders as this helps to analyze and Trade size: Forex pairs are , units per 1 lot, but units per 1 lot vary on non-forex pairs. In this field there's the option of calculating the pip value based on the lots traded or the units traded. Let's choose, on our example, a trading size lot of 10, units ( mini lot) Let us see how we can calculate oil in the WTI forex platform Metatrader. Lot Size of Crude Oil – oil pips in MetaTrader. The smallest price change for Crude Oil is or 1 pip. So when the price rises from till , it is 1 pip. If we trade Oil on the Metatrader platform, then 1 micro lot trading size for 1 pip target is $

No comments:

Post a Comment