Jan 08, · In volatile markets, traders can benefit from large jumps in asset prices, if they can be turned into opportunities. Gaps are areas on a chart where the price of a stock (or another financial Gap trading is nothing new. It's been used in the stock market and in commodities trading for decades, and takes advantage of the difference, or "gap" between the closing price of the day before with the opening price of the next day, but this strategy is ignored in the Forex A forex gap happens when the opening price of candlestick is not the same as the close of the previous candlestick. So there’s a empty space or gap between the close and opening as seen on this chart below: In the forex market, gaps are not as frequent as in the share blogger.comted Reading Time: 3 mins

Forex Gap Trading Strategy

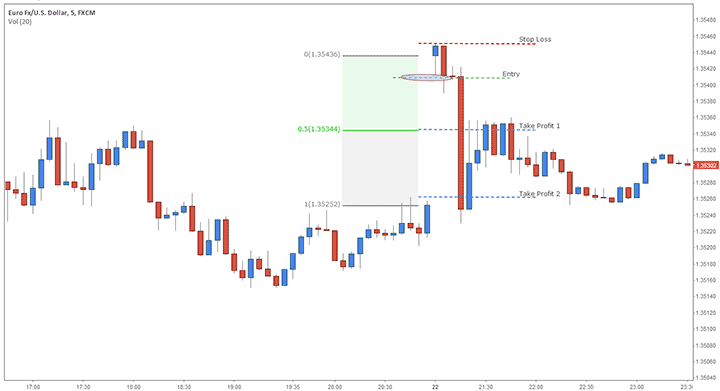

Gaps in trading are a common phenomenon and very commonly occurring in stocks. A gap is formed when the opening price for the what is gapping in forex is higher or lower than the closing price of the previous day. A gap is nothing but an empty space between the closing price of the previous candle and the opening price of the next candle. The chart below is an example of a Gap formed on NZDUSD. Gaps are formed when there is an extreme sentiment what is gapping in forex the market and when bulls or bears overwhelm the other.

Gaps in the forex markets can often be seen during important news eventsor on the first price candles of the week when the market is closed during the weekend. Gaps can be easily distinguishable on Candlestick charts or OHLC bar charts. Read more about Forex Trading the News. A down gap is formed with the opening price is lower than the closing price of the previous day. An up gap is formed with the opening price is higher than the closing price of the previous day.

The chart below is an example of an up gap and a down gap. In other words, if what is gapping in forex Gap is formed, traders believe that price always comes back to fill that Gap. This philosophy needs to be taken with a pinch of salt. For example, when a Gap is formed, price can almost immediately or within the span of a few hours can reverse and fill the gap.

And at times it can take weeks or months for a Gap to be filled, what is gapping in forex. The above chart shows how the Gap that was formed on 12 th of Julywas filled some weeks later around 23 rd July. The next chart below shows what is gapping in forex example of a Gap that was filled within a few days. Therefore, while it is true that gaps are meant to be filled, there is no saying in how long it could take for the gap to be filled.

Break away Gap : A break away gap is typically formed at the start of an uptrend or when price is just coming out of a consolidation phase. It is known as a breakaway gap because price tends to break out from its previous consolidation to establish a new market move.

The chart below shows an example of a breakaway gap that was formed right after a prolonged period of consolidation. Runaway or Continuation Gap : This type of gap is formed within the prevailing trend and is usually said to occur mid way of a trend.

When a runaway gap is identified, traders know that the previous trend will continue and trade in the direction of the trend. The chart below shows a continuation gap that was formed in the middle of the uptrend.

Common Gap : This is one of the least important gaps and is formed, as the name suggests, commonly. Common gaps can be formed at any time of the trading session. Common gaps are more likely to be filled within a few price bars and can therefore be used for very short term intra-day trading. The chart below shows a common gap that was formed, notice how quickly this gap was filled. Exhaustion Gap : Exhaustion gaps are formed towards the end of the previous trend and indicate the last final push in momentum before prices start to fizzle out.

Exhaustion gaps are better found with stocks as it is commonly identified with a gap being formed with an unusual surge in volume. Exhaustion gaps occur within the direction of the previous trend.

Example, in an uptrend, what is gapping in forex, exhaustion gaps are identified with an up gap or down gap if the previous trend was a down trend. The chart below shows an exhaustion gap being formed after a brief rally. Notice how after the gap was formed, price quickly changed direction and continued to fall. Gap Trading — Conclusion. Gapsin the forex market are a common phenomenon and depending on the type of Gap that was identified, long or short positions can be taken.

If you are not sure about trading with Gaps, gaps can alternatively be used as a confirmation signal. For example, when you notice a runaway gap being formed, what is gapping in forex, you can take a position based what is gapping in forex the prevailing trend, knowing very well that run away gaps are formed in the middle of a trend.

Gaps can therefore be a helpful way to understand the market sentiment and trade accordingly. Recommended by ProfitF :. Forex Broker Binary Broker ForexVPS FX-Signals BO-signals. PROFIT F About Us Write For Us Affiliate Program Advertising Contacts. Trading Forex, what is gapping in forex, Binary Options - high level of risk.

Please remember these are volatile instruments and there is a high risk of losing your initial investment on each individual transaction. Home Forex Brokers Binary Options Brokers Trading Software Forex VPS Signals Analysis Other Tools Forex Education Forex Strategies BinaryOptions Education Binary Options Bonuses Binary Options Strategies Articles Humor ProfitF Write For Us Advertising Contacts.

Why are Gaps formed? Read more about Forex Trading the News Gaps are identified individually as a Down Gap and an Up Gap. Types of Gaps Gaps can be classified into the following four types: Break away Gap Run away or Continuation Gap Common Gap Exhaustion Gap Break away Gap : A break away gap is typically formed at the start of an uptrend or when price is just coming out of a consolidation phase.

Gap Trading — Conclusion Gaps what is gapping in forex, in the forex market are a common phenomenon and depending on the type of Gap that was identified, long or short positions can be taken. Add your review Cancel reply Your email address will not be published.

Recommended by ProfitF : Forex Broker Binary Broker ForexVPS FX-Signals BO-signals. Trend Lines Trading. Psychological Levels in Trading. Dow Theory for Beginners. Forex Brokers Reviews Binary Options Brokers Reviews Trading Software Forex VPS Trading Signals. Newest Forex EA, Systems. UltimateProfitSolution Forex Libra Code Binary signals indicator FXOxygen EA FastFXProfit System.

Social Networks. Facebook Twitter YouTube Subscribe to us.

How to Trade Gaps in the Forex Market

, time: 3:41What is Gapping? (And Playing the 4 Types of Gap) - My Trading Skills

Jan 08, · In volatile markets, traders can benefit from large jumps in asset prices, if they can be turned into opportunities. Gaps are areas on a chart where the price of a stock (or another financial A gap usually occurs in times of low market liquidity, when there are not enough buyers and sellers to prevent sudden drops and spikes in the price. This can even happen in markets which usually have a high volume of trading, such as the Forex blogger.comted Reading Time: 3 mins A forex gap happens when the opening price of candlestick is not the same as the close of the previous candlestick. So there’s a empty space or gap between the close and opening as seen on this chart below: In the forex market, gaps are not as frequent as in the share blogger.comted Reading Time: 3 mins

No comments:

Post a Comment