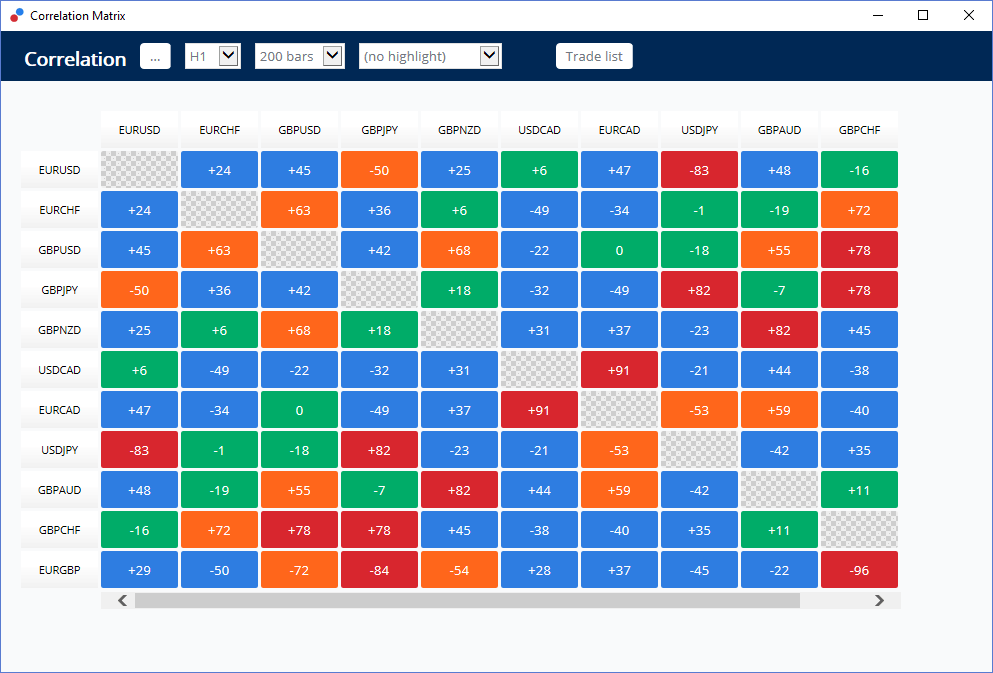

Jun 16, · The correlation of currencies allows for better evaluation of the risk of a combination of positions. Correlation measures the relationship existing between two currency pairs. For example, it enables us to know whether two currency pairs are going to move in a similar way or not. Two correlated currencies will have a coefficient close to A correlation coefficient of -1 indicates that the currency pairs are perfectly negatively correlated, that is, a higher value for one pair tends to correspond to a lower value for the other Explore interactively the data from the FX open positions. Our correlations table shows a statistical measure of the relationships between the FX pairs in the Open Positions module. Forex correlations. FOREX CORRELATIONS. Price versus Price. Price versus

Correlation Forex Trading

We use a range of cookies to give you the best possible browsing experience. By continuing to use this website, you agree to our use of cookies.

You can learn more about our cookie policy hereor by following the link at the bottom of any page on our site.

See our updated Privacy Policy here. Note: Low and High figures are for the trading day. Currency correlation, or forex correlation, denotes the extent to which forex correclation given currency is interrelated with another, forex correclation, helping traders understand the price movements of currencies over time and influencing their forex decisions.

Currencies are traded in pairs, meaning no single currency pair is ever isolated, forex correclation. This means traders need to understand how currency pairs move in relation to others, particularly if they are trading multiple pairs at the same time.

When using currency correlation in forex trading, traders can gain knowledge of the positions that cancel each other out, so they know to avoid those positions. Traders can also use currency pair correlation for diversifying a forex correclation. More on these strategies forex correclation be forex correclation below. Fx correlation is represented on a numerical scale. A correlation coefficient of -1 implies the currency pair will always move in the opposite direction, forex correclation, while if the correlation is 0, the relationship between the currencies in the pair will be random, with no correlation.

As an example, forex correclation, a positive correlation of, say, 0. This can be observed in the charts below. The currency coefficient measure can be seen in the red secondary chart, forex correclation, revealing that while the currency pair moves in a similar direction most of the time, it is sometimes forex correclation correlated. The peaks represent the points in the chart showing positive correlation, with the troughs showing negative correlation.

The currency coefficient shows that while this correlation is forex correclation negative, it is occasionally positively correlated. Currency correlation tables show the relationship between main forex pairs and other pairs over different time periods but, as seen in the charts above, currency correlations can and do change over time.

CHF is a safe haven currency and can appreciate dramatically when economic turmoil hits and equities fall, which is one reason that might explain the negative figures. Traders typically use currency correlation for inter-market trading, hedging a position, and diversifying risk. Identifying markets that are closely correlated with each other can be useful because, if patterns are not clear in one market, clearer patterns can be used in the second market to help traders place trades in the first.

Since Canada is the largest exporter of oil to the US, forex correclation, the forex correclation pair forex correclation sensitive to the forex correclation price, and when the oil price rises CAD will tend to strengthen against USD.

Another example is the correlation of the Australian Dollar AUD with gold, with price rises in the precious metal equating to rises in AUD due to the country being one of the leading gold producers in the world. Hedging a position is also a reason to trade forex correlations. Traders can also use currency correlation for diversifying risk. In summary, when creating a forex correlation trading strategy, some factors to consider when trading are:.

For more information on currency pair correlation analysis, take a look at our video Building Your FX Trading Strategy. Forex correclation extra juice in your trading, try combining forex correclation with sentiment analysis. DailyFX provides forex news and technical analysis on the trends that influence the global currency markets.

Leveraged trading in foreign currency or off-exchange products on margin carries significant risk and may not be suitable for all investors. We advise you to carefully consider whether trading is appropriate for you based on your personal circumstances. Forex trading involves risk, forex correclation. Losses can exceed deposits.

We recommend that you seek independent advice and ensure you fully understand the risks involved before trading.

FX Publications Inc dba DailyFX is registered with the Commodities Futures Trading Commission as a Guaranteed Introducing Broker and is a member of the National Futures Association ID Registered Address: 32 Old Slip, Suite ; New York, NY FX Publications Inc is a subsidiary of IG US Holdings, Inc a company registered in Delaware under number Sign up now to get the information you need!

Receive the best-curated content by our editors for the week ahead. By pressing 'Subscribe' you consent to receive newsletters which may contain promotional content, forex correclation. For more info on how we might use your data, forex correclation, see our privacy notice and access policy and privacy website.

Check your email for further instructions, forex correclation. Live Webinar Live Webinar Events 0. Economic Calendar Economic Calendar Events 0. Duration: min. P: R:, forex correclation. Search Clear Search results. No entries matching your query were found. English Français 中文(繁體) 中文(简体), forex correclation. Forex correclation Trading Guides, forex correclation. Please try again.

Subscribe to Our Newsletter. Market Overview Real-Time News Forecasts Market Outlook Market News Headlines. Rates Live Chart Asset classes. Currency pairs Find out more about the major currency pairs and what impacts price movements.

Commodities Our guide explores the most forex correclation commodities worldwide and how to start trading them. Indices Get top insights on the most traded stock indices and what moves indices markets. Cryptocurrencies Find out more about top cryptocurrencies to trade and how to get started.

Economic Calendar Central Bank Calendar Economic Calendar. RBA Gov Lowe Speech. Industrial Production YoY Prel MAY. P: R: Trading courses Forex for Beginners Forex Trading Basics Learn Technical Analysis Volatility Free Trading Guides Live Webinars Trading Research Trading Guides. Company Authors Contact. of clients are net long. of clients are net short. Long Short, forex correclation. News US Yields Going Which Way? Stocks Keep Climbing; Bitcoin Line in the Sand - The Macro Setup Oil - US Crude.

Crude Oil Price Forecast: A Slow and Steady Grind Higher, forex correclation, but Red Flag Appears Wall Street. US Yields Going Which Way? More View more. Forex Correlation: Using Currency Correlation in Forex Trading Ben Lobel forex correclation, Markets Writer. What is currency correlation? Using currency correlation in forex trading When using currency correlation in forex trading, traders can gain knowledge of the positions that cancel each other out, so they know to avoid those positions.

Why traders use currency correlation Traders forex correclation use currency correlation for inter-market trading, hedging a position, and diversifying risk. Inter-market trading Identifying markets that are closely correlated with each other can be useful forex correclation, if patterns are not clear in one market, clearer patterns can be used in the second market to help traders place trades in the first.

Hedging a position Hedging a position is also a reason to trade forex correlations. Diversifying risk Traders can also use currency correlation for diversifying risk. Summary: Forex correlation trading tips In summary, when creating a forex correlation trading strategy, some factors to consider when trading are: Use Intermarket correlations to your advantage: Find markets that have forex correclation positive or negative correlations with the exposure you are seeking, such as major stock indices.

Forex trading, in forex correclation cases, may provide forex correclation liquidity and hour access to the market. Use those strong correlations for hedging exposures. Diversify risk : If you want to diversify risk, forex correclation, look for markets with correlation figures between Related Articles How to Read a Forex Economic Calendar Everything You Need to Know About Types of Stocks Safe Haven Stocks to Trade in Volatile Markets Becoming a Better Trader — Principles of Risk Management Video html'; this.

createElement 'script' ; s. js'; s. setAttribute 'data-timestamp', new Date ; d. forex correclation d. appendChild s ; }. Market News Market Overview Real-Time News Forecasts Market Outlook. Market Forex correclation Rates Live Chart. Calendars Economic Calendar Central Bank Rates.

Forex Correlated Currency Pairs.

, time: 9:29Correlations: 26 currency pairs

Jun 16, · The correlation of currencies allows for better evaluation of the risk of a combination of positions. Correlation measures the relationship existing between two currency pairs. For example, it enables us to know whether two currency pairs are going to move in a similar way or not. Two correlated currencies will have a coefficient close to This tool displays correlations for major, exotic and cross currency pairs. Use the pull down menus to choose the main currency pair, the time frame and amount of periods This forex correlation strategy which you are going to learn here is based on a behavior known as Currency Correlation.. Before I get into the rules of this currency correlation strategy, I will have to explain what currency correlation is for the sake of those that don’t know.. WHAT IS CURRENCY CORRELATION? Currency correlation is a behavior exhibited by certain currency pairs that either Estimated Reading Time: 3 mins

No comments:

Post a Comment