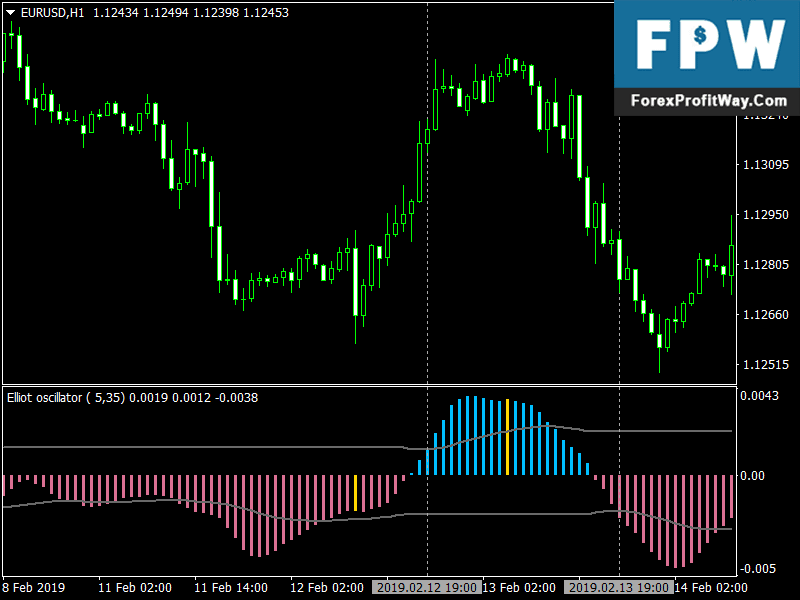

4/5/ · The stochastic oscillator is a momentum indicator that is widely used in forex trading to pinpoint potential trend reversals. This indicator measures momentum by 1/15/ · Most traders use multiple oscillators to confirm range extremes and for determining the important entry and exit points. RSI is a popular oscillator use Stochastic Oscillator to create a forex 2/26/ · The Awesome Oscillator Indicator (AO) is a technical analysis indicator created by an American trader Bill Williams as a tool to determine whether bullish or bearish forces dominate the market. It measures the market momentum with the aim to detect potential trend direction or trend reversals

How to Use Oscillators to Warn You of the End of a Trend - blogger.com

The Forex volume indicator displays the relative strength of a shorter volume moving average with a longer one. To keep things simple, any positive reading for the volume oscillator indicates the strength in the short-term in the direction of the current trend. If the volume oscillator is on the negative territory, the volume is lacking and the trend may change.

This indicator will teach you how much volume is required to confirm buy and sell trade signals. More the volume oscillator indicator will reveal the formula behind the Forex volume readings. Stock traders know the importance of volume analysis as it is visible to all traders. Volume, interest and price action are the key components in any stock trading decisions. However, unlike stock trading, the volume is rarely used in the Forex what is oscillator use for forex. And, there is a solid reason for that.

The foreign exchange market is a decentralized market where trading happens without any central interventions. Therefore, there is no formula for measuring volume or method of keeping track of the contract number and contract size. However, it is possible to trade in the forex market with a volume oscillator indicator and we will see some ways by this article. Forex volume indicators are those that vary over time within a band. A volume oscillator is a part of the oscillator indicator.

In this indicator, volume tracks the bullish and bearish activity on the specified timeframe. This technical tool mostly has the shape of sine what is oscillator use for forex. These sine waves will vary over time, between the set band below or above the centerline. The characteristics of the volume oscillator are mostly the same as the volatility. This indicator considers the volume as the difference between two moving averages. A fast-moving average is typically 14 days and the slow-moving average is 28 days.

The difference between the 14 and 28 moving averages works as a sine wave, what is oscillator use for forex. However, you can change the built-in value following your trading needs, what is oscillator use for forex. Many traders use lots of price action analysis but ignore the volume oscillator indicator. Using this indicator, traders can increase their profits and minimize their losses.

Sometimes traders get confused as there are several types of volume oscillator indicators. In the forex market, the price goes up when the buyers dominate the market and the price goes down when the sellers dominate the market.

The volume oscillator indicator has the capacity to draw the attention of any unusual buying and selling activities in the market. In this indicator, price moves from the period of low volume activity to high volume activity and vice versa. Therefore, the ability to spot these activities can help traders to trade alongside the big players.

High volume, either in the bullish or bearish side can generate trends or an indication of the change in the trend direction. Volume analysis can help you predict these trends before they are visible on the chart. Read More: Things You Should Know About Leverage in Forex Market. There are several ways to trade forex using the volume oscillator indicator, what is oscillator use for forex.

Of them, we will see some of the well-known strategies. In the forex market, breakouts what is oscillator use for forex a higher failure rate.

The reason behind this is that it is very easy to reduce the price from higher to lower instead of higher to higher. In any market, an increase in price reduces the interest of buyers.

As a result, price falls higher to lower. Moreover, a breakout is just breaking below or above the recent high or low. There is no mystical Fibonacci level or a trendline. Therefore, it becomes harder for traders to determine the sustainability of any breakout. A volume oscillator allows traders to know whether the breakout will sustain or not. Any breakout with higher volume indicates an involvement of smart money. Therefore, the breakout with higher volume will be successful and traders can enter the trade after some corrections with their trading strategy.

In this chart, the volume oscillator got a bullish breakout after a correction, what is oscillator use for forex.

On the other hand, Price got a bearish rejection with a candle close in the same period. This is a perfect example of identifying the trend reversal with a volume oscillator. However, you can find many unsuccessful breakouts that are also indicated by the volume oscillator. In this chart, price breaks out the resistance with a candle close.

But as the movement was not supported by the Volume Oscillator, price reversed. It makes some corrections after an impulse and continues the current trend. We can measure the volume of a current trend to identify the strength of the trend.

A bullish trend with the bigger volume on the bullish side indicates that the current trend is strong and any trade setups towards the bullish trend will be more successful.

Therefore, you should follow the bias in case of taking any trading entry. In this picture, the bullish trend is supported by the volume oscillator indication. As a result, the trader can take intraday trade entry towards the direction of the price. In a choppy market, buyers and sellers usually fight with their trading volumes. As a result, you will see a bullish pressure in the volume Oscillator indicator.

Still, it will dominate by another bearish volume oscillator immediately. You should be careful and probably avoid trading in the choppy market with this indicator. However, what is oscillator use for forex, you can monitor the market and wait for a breakout what is oscillator use for forex any side to join the rally. Another method to trade with the Volume Oscillator is to draw trendlines on the indicator. The aim here is to identify breakout patterns on the indicator to signal the trend.

The best use with the trendline is the identity of divergence. As we know, the divergence is basically the opposite reaction of price and oscillator. There are many types of divergence, but the main concept is what is oscillator use for forex same. Any divergence in the price and oscillator is a possible price reversal signal. If you find that the price is making higher highs indicating uptrend, but the volume oscillator indication is making lower lows.

There may be some problem with the trend. In that case, it is unlikely to say that the price may reverse. Therefore, you should wait for an appropriate selling entry with your own trading strategy. The Forex volume oscillator is like other indicators that can prove useful when combined with the price action and trend lines. In addition to that, understanding the market context is the key to any forex pairs.

You should know the four main elements of the market context, including market volatility, non-volatility, impulse, what is oscillator use for forex, and correction.

The article was updated by Samson and originally published on 12 December and updated on 29 July Publish on AtoZ Markets. Get Free Trading Signals Your capital is at risk. close ×.

How To Use Awesome Oscillator For Day Trading (Forex \u0026 Stock Trading Strategies)

, time: 7:11How to read and use the Awesome oscillator trading indicator? | blogger.com

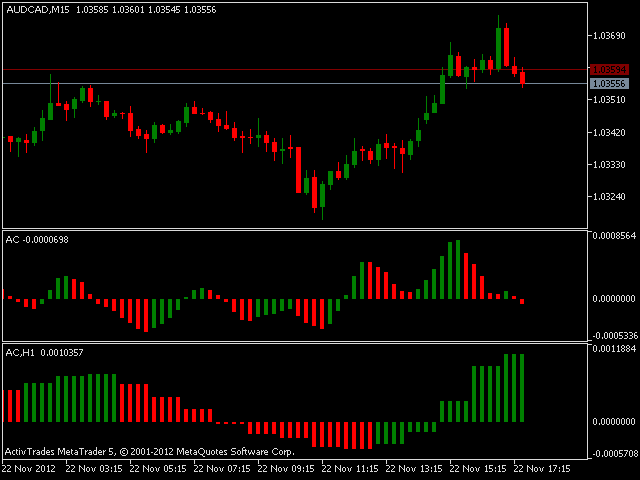

11/13/ · The Accelerator Oscillator often signals price changes ahead of price itself and is said to be most effective when used in conjunction with the Awesome Oscillator. The AC oscillator is calculated as the difference between the Awesome Oscillator and the Estimated Reading Time: 4 mins 4/22/ · Oscillators work under the premise that as momentum begins to slow, fewer buyers (if in an uptrend) or fewer sellers (if in a downtrend) are willing to trade at the current price. A change in momentum is often a signal that the c urrent trend is blogger.comted Reading Time: 3 mins 10/30/ · Anything can be an oscillator. Think of one of the most used one: the Bollinger bands: there is an up band (limit) - there is a down band (limit) - there is a middle (zero) line. Those are all elements of an oscillator which makes a Bollinger bands an oscillator even though majority do not think of it that way

No comments:

Post a Comment