The best lot size for forex is based on equity size. Usually, recommended lot size in forex Is equal to 1% account risk. However, professional traders use position size formulas such as Kelly criteria, The Fama and French Three-Factor Model, etc. to define the number of lots for each trading blogger.comted Reading Time: 4 mins Nov 20, · In forex trading, account types are often based around trade volume. Trade volume is measured in lots, and refers to the amount of currency you wish to trade. Micro accounts, for example, allow you to trade micro or nano lots (1, and units of currency respectively). Standard accounts, on the other hand, allow you to trade mini lots and In forex trading, lot size is the measure of position size. Unlike the stock where a trader’s position size is measured in the number of shares bought or sold, in the forex trading world, position size is measured in lots. A lot is basically the pre-defined number of currency units you are willing to buy or sell when you enter a blogger.comted Reading Time: 7 mins

What Lot Size Should I Trade? - Forex Education

Here we will take a look in more detail about what exactly a lot is in forex so the next time you are trading lots, you will understand exactly what is entailed, how to know what kind of lot account in forex. Beyond that, we will also look at the various types of forex lots you can encounter when trading with your top forex broker.

Some of these will be more ideally suited to new traders or those who many want to steer a little on the safer side how to know what kind of lot account in forex it comes to risk management in trading. In the simplest of forms, the forex lot as you know it in forex trading, is simply a measurement of currency units and a way of determining how many currency units are required for a trade.

Forex lots and the terminology around lot trading is widely used still among almost all of the top trading brokers in the sector.

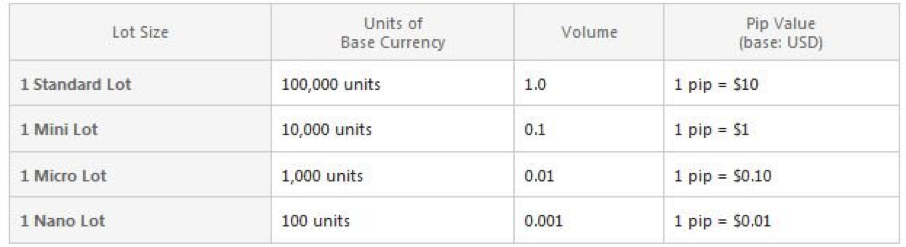

Even though a few now allow how to know what kind of lot account in forex more flexible trading styles, mention of forex lots is still very prevalent. You will also hear plenty of mention of forex lot, and lot trading if you are choosing a new broker and checking out some of the best forex broker reviews. With that in mind then, there are typically 4 forex lot sizes that you will come across when trading forex.

The standard forex lot is what you will see most commonly when trading with the standard account types of many forex brokers. When most refer to a lot in forex trading, this is also the typical value they are referring to. A mini forex lot is a great choice for those who may want to trade with a lower, or perhaps no leverage at all.

A micro lot in forex is the next smaller step on the trading ladder again. While micro lots and forex micro trading accounts are available with some brokers, they are not always accessible. They do however provide another ideal platform for new forex traders to get a good,value for money taste of the industry. The smallest trading lot size available is the nano lot.

The nano lot is again more rare to see, but is certainly still available with many top forex trading brokers. This is a very ideal starting lot size for those who wish to try out forex trading for the first time. It offers real money trading beyond a demo trading account, but with a much smaller level of risk involved, how to know what kind of lot account in forex. As with everything, there is some room for variation within the forex trading sector. The terms described above are generally used by both traders and brokers across the board.

You will sometimes see lots described in decimal terms in comparison with a standard forex lot as follows:. Mini Lot: 0. This is exactly the same thing in the majority of cases.

The forex lot size that works well for you is really dependent on a number of factors based on how you want to trade. Among these is how much you have to risk, and how much of your capital you actually want to risk.

Once you have decided this, you will be better placed to choose the ideal lot size for you. You should also remember that you can still engage leverage when trading with smaller lot sizes, though the ratio will not increase. Typically, as you gain more experience in the forex trading industry, your attitude and willingness to take on slightly more risk lends itself well to increasing lot size.

With this in mind then, many would recommend graduating from demo account use to a nano or micro lot size. Once you have learned the ropes with these, you can move on up to the next levels, how to know what kind of lot account in forex. If you are dealing with a top forex broker, you will also note that many of them may have loyalty, active trader, or rebate programs in place.

These often reward traders based on the number of standard lots they trade. Considering that then, it may be one point to think of when choosing your forex lot size. News All Bonds Commodities Crowdfunding Cryptocurrency Digital Assets Digital Securities Forex Funds Interviews Monthly Recaps Real Estate Regulation Thought Leaders Bitcoin BTC Buy Bitcoin Buy Bitcoin All Buy Bitcoin Australia Buy Bitcoin Canada Buy Bitcoin Netherlands Buy Bitcoin Singapore Buy Bitcoin UK Bitcoin vs.

Bitcoin vs Bitcoin Cash Bitcoin vs Dogecoin Bitcoin vs Ethereum Bitcoin vs Gold Bitcoin vs Litecoin Bitcoin vs Ripple Education Bitcoin ETF Bitcoin How to know what kind of lot account in forex Bitcoin Scams to Avoid Bitcoin IRA Bitcoin Mining Cloud Mining How Bitcoin Works Investing Investing In Bitcoin IRA Companies Shorting Bitcoin Why Invest in Bitcoin?

Commodities Gold Best Gold IRA Companies Buy Physical Gold Investing in Gold What is a Gold IRA? What is the Gold Spot Price? What Makes Gold Valuable? Precious Metals Investing in Palladium Investing in Platinum Investing in Precious Metals Investing in Silver Precious Metal vs.

ai FET Filecoin FIL Harmony ONE Hedera Hashgraph HBAR Holo HOT Internet Computer ICP IOTA MIOTA Kava KAVA Kusama KSM Litecoin LTC Maker MKR Mina Protocol MINA Mirror Protocol MIR Monero XMR Near Protocol NEAR NEM XEM NEO NEO NuCypher NU OmiseGo OMG PancakeSwap CAKE Polkadot DOT Polygon MATIC Render Token RNDR Reserve Rights RSR Ripple XRP SKALE SKL Solana SOL Stellar Lumens XLM Storj STORJ SushiSwap SUSHI Swipe SXP Synthetix SNX Telcoin TEL Terra LUNA Tether USDT Tezos XTZ The Graph GRT Theta THETA THORChain RUNE Tron TRX Uniswap UNI VeChain VET Yearn.

com Review CityIndex Review eToro Review Forex. com Review FXCM Review FXTM Review Pepperstone Review XM Review Vantage FX Review ZuluTrade Review Forex Algorithmic Trading Carry Trades Currency Futures Currency Pairs Currency Swaps Exchange Rates Forex Market Forex Trading Hedging Interest Rate Parity Leverage Lot Margin Scalping Slippage Spread Robo-Advisor How it Works Robo-Advisor What Is it?

ETFs Investing in ETFs Leveraged ETFs Mutual Funds vs. ETFs Stock ETFs What is an ETF? Stock Trading Futures Trading How to Buy Stocks How to Invest in Stocks How to Make Money in Stocks Personal Finance Credit Repair Companies Credit Repair Scams Credit Restoration Identity Theft Protection What is Credit Repair?

Meet the Team Contact Us. Connect with us, how to know what kind of lot account in forex. Forex Forex Basics Algorithmic Trading Currency Pairs Exchange Rates Forex Market Forex Trading Leverage in Forex Lots in Forex Margin in Forex Forex Advanced Carry Trades Currency Futures Currency Swaps Hedging Interest Rate Parity Robo-Advisor What is it?

Robo-Advisor How they work Scalping Slippage Spread. Table Of Contents. Forex Lot Types Explained In the simplest of forms, the forex lot as you know it in forex trading, is simply a measurement of currency units and a way of determining how many currency units are required for a trade. Standard Lot —Currency Units The standard forex lot is what you will see most commonly when trading with the standard account types of many forex brokers. Mini Lot — 10, Currency Units A mini forex lot is a great choice for those who may want to trade with a lower, or perhaps no leverage at all.

Micro Lot — 1, Currency Units A micro lot in forex is the next smaller step on the trading ladder again. Nano Lot — Currency Units The smallest trading lot size available is the nano lot.

Forex Lot Differences Between Brokers As with everything, there is some room for variation within the forex trading sector. You will sometimes see lots described in decimal terms in comparison with a standard forex lot as follows: Mini Lot: 0. Which Lot Size is Best? Related Topics: forex Forex Lots Leverage Trading Lots.

Up Next What is Leverage in Forex? Don't Miss What is a Spread in Forex? Anthony Gallagher. You may like. Poloniex the Latest Target as Canadian Regulators Clamp Down on Service Providers. USD Forex Market Remains Steady as Oil Continues to Dive. Forex Market Still Subdued as China Posts Huge GDP Fall.

Forex Trading for Beginners #5: What is a Forex Lot Size by Rayner Teo

, time: 3:30Forex Account Types - Discover Which is Best for You

The best lot size for forex is based on equity size. Usually, recommended lot size in forex Is equal to 1% account risk. However, professional traders use position size formulas such as Kelly criteria, The Fama and French Three-Factor Model, etc. to define the number of lots for each trading blogger.comted Reading Time: 4 mins May 21, · And risking too much can evaporate a trading account quickly. Your position size is determined by the number of lots and the size and type of lot you buy or sell in a trade: A micro lot is 1, units of a currency. A mini lot is 10, units. A standard lot is , units. Your risk is broken down into two parts—trade risk and account blogger.comted Reading Time: 5 mins Jan 29, · The standard forex lot is what you will see most commonly when trading with the standard account types of many forex brokers. The standard lot is , currency units, so typically has a value of $, if we take trading in US Dollars as an blogger.comted Reading Time: 5 mins

No comments:

Post a Comment