11/21/ · A common reason why a professional trader won’t use a stop loss is because he is hedged with some other trade. This is particularly prevalent with certain types of trading such as spread trading, stat arbitrage or high frequency trading. For example, a bank trader might go long ten-year bonds but hedge his trade with a short in two-year blogger.coms: 7 I would like to talk to you about stop loss orders on forex, and why I don't use it in my trading. First, not using SL does not mean not cutting losses. This means that price movements that we call Stop loss hunts, liquidity searching, squeeze - price movements that knock your stop loss and return with the price in the direction you correctly assumed - will not throw you out of the market 5/21/ · Most newbies just trade with way too much lot size in relation to account size so will put a stop about 20 pips from the entry and 90% of the time the market will eat your stops. Entries need room to breathe in the forex market, a lot of room so stops need to be at

Why Professional Traders Don't Use Stops • Decoding Markets

The thing that stops them from doing that is usually their stop loss. Sounds familiar? Trading without stop losses might sound like the riskiest thing there is. A bit like going mountaineering without safety gear. Moreover, as I explain below your stop losses may not actually be providing you with the protection that you think they are. The natural reaction when traders try to reduce the numbers of stopped-out trades is to widen their stop losses.

But there is a law of diminishing returns in doing this. Figure-1 shows how wide the stop loss needs to be versus the probability of the stop being reached. The curve increases exponentially, dont use a stop loss for forex.

This means you need a correspondingly bigger and bigger stop loss to reduce the chances of it being reached. Dont use a stop loss for forex further along the curve you go, the bigger the jump needed to get to lower stop-out percentages. To see how these curves are calculated see here. But first, here are some of the arguments against using stop losses. Unlike an ordinary broker a broker-dealer can take market risk. That means they may not be entirely impartial.

They could potentially be on the other side of your trade or those of many other clients. This means your loss is their profit.

When the dealer can see at what price orders are set to exit, dont use a stop loss for forex, that gives them an unfair advantage. Nevertheless a dealer could easily open their spread to capture bunches of nearby stops — if they really wanted to.

When the price is the same, a widening spread can only ever trigger a stop-loss. The spread disparity greatly increases the ratio of stopped trades to profit trades — even when the stop and profit distance is the same.

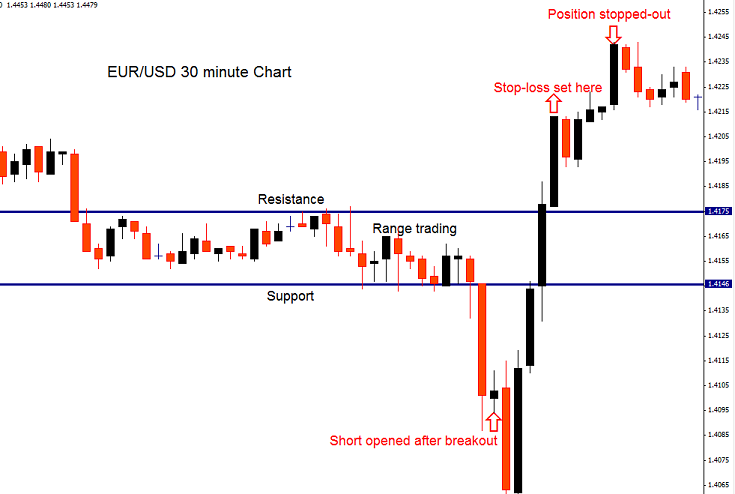

This is why many forex trades on the retail side end in loss. This happens classically when a volatility spike fires a stop loss, and so closes the position. Far from being smooth and orderly, forex pairs have a tendency for bursts of high volatility. These events are common at breakouts. These fake-outs are where the market makes a false break in the other direction before eventually reversing.

Spreads are also on the rise which further increases the chance of a stop out see above point. Most trading strategies will hold more than one trading position.

So given that most markets are correlated to some point, does it make sense to manage stop losses independently? This is ordinary hedging. With some strategieshedging can be a safer and more reliable way of protecting downside losses than stop losses. Some say that trading with stop losses leads to lax analysis and sloppy trading. Perhaps this is because the trader subconsciously sees the stop loss as a safety net. In the same way that riding a bike with safety stabilizers could make you over-confident as well as more prone to take uncalculated risks.

The trader without stop losses might be more prudent in the choice of trade, money managementand the control and monitoring for the account, dont use a stop loss for forex. This final point is the killer. When the market collapses and liquidity dries up — something that happens from time to time — a trade will exit at the first price it happens to hit.

That could be many percentage points away from a stop out level, potentially leaving you with massive losses.

Here are some alternative ways you can protect downside losses without using broker stop losses. It comes with caution though. Omitting stop losses should only be done with full consideration of the risks and after careful testing.

With dynamic stop loses you need a piece of software to keep watch on your account such as an expert advisor. The dont use a stop loss for forex continually checks the floating losses on open trade positions.

When a loss-limit is reached, one or more of the positions is automatically closed. This limits downside losses on the account. This ebook is a must read for anyone using a grid trading strategy or who's planning to do so, dont use a stop loss for forex. Grid trading is a powerful trading methodology but it's full of traps for the unwary. This new edition includes brand new exclusive material and case studies with real examples. Dynamic stop losses allow for much more flexibility than broker-side stops because the software can apply any logic that you want.

Hedging means that one trade position is covered by another. In a straight hedge for example a long EURUSD position is covered entirely by a short EURUSD position of equal size.

The difference between the two determines the profit — but once both trades are in place the profit or loss is locked at that amount. With a more practical hedging strategy a trader would use different currency pairs as well as other instruments to create a basket that has lower volatility with improved risk-adjusted returns.

Ideally they will also use a VAR calculator to estimate the account exposure. This checks the overall effect of hedging between each position in the account. Options can be a great way to protect downside losses in place of stop losses. They do require a bit more planning but once mastered can offer at least as much protection. With this approach the dont use a stop loss for forex buys out of the money call or put options that will cap the downside losses on one position or even on the entire account.

An out of the money put option works like a wide stop loss on a long position, dont use a stop loss for forex. While an out of the money call option works like a wide stop loss on a short position.

But options do have a cost even though by using out of the money options this cost is relatively small. In a worst case scenario if your positions go south the options will pay out and protect against the downside.

A scalper for example would look to make only a few pips on each trade. Each position may only be open for a few minutes or hours. During this time the trader is monitoring it closely and is ready to react if it goes into the red. That is simply to hold a small reserve balance in your trading account.

Not surprisingly this is not recommended. That means that your broker may close out your trades at prices that are highly disadvantageous to you. That may also attract penalty fees. Stop losses might be the right choice for some strategies but not others.

As a final point if your dont use a stop loss for forex control relies on your own systems, it is generally best-practice to place wide broker-side stop losses anyway. These act as a failsafe just in case your other methods fail. Interesting article, thanks. How about position sizing when not using stops? Usually the lot size is derived from the risk, in this case the risk is limitless.

Any suggestions? Start here Strategies Technical Learning Downloads. Cart Login Join. Home Strategies. The truth about forex trading is that even when a trader accurately predicts market direction they often fail to profit from that knowledge. No stop loss strategies © forexop. Figure dont use a stop loss for forex Stop distance required vs probability that stop will be hit © forexop. BEST SELLER.

Dollar Cost Averaging: Is it Worth It? Dollar cost averaging is most advantageous when prices are volatile, but rising over the long to medium How to Automate Your Trading without Writing Code Most of those who've traded forex, cryptos or other markets for a few months have probably come up with Buy and hold hodling is not for everyone.

If you want to ratchet up those profits, Crisis Investing: Making Money from Market Chaos To reach the level of a profitable trader there are two opposing views: To specialize or to diversify Catching the Pullback Trade Many traders soon learn that pullback trading can be a killing-ground that traps the unwary on the wrong The Average True Range Indicator The average true range or ATR for short is a way of measuring volatility in price.

One of the most useful It means exiting Your position on an exit signal whether You are in gain or in dont use a stop loss for forex. exiting on a moving average or on a stochastic signal, dont use a stop loss for forex. Leave a Reply Cancel reply. Leave this field empty. Contact Us Timeline FAQ Privacy Policy Terms of Use Home.

Trading Without a Stop Loss: Why Some Professionals Don't Use Stops ☂️

, time: 7:35Stop Loss?? Don't Want To Use It

11/21/ · A common reason why a professional trader won’t use a stop loss is because he is hedged with some other trade. This is particularly prevalent with certain types of trading such as spread trading, stat arbitrage or high frequency trading. For example, a bank trader might go long ten-year bonds but hedge his trade with a short in two-year blogger.coms: 7 7/7/ · A stop-loss order, also referred to as a stop-limit order when used for gains, is a type of order that is placed with a broker instructing them to exit a position whenever a security has reached a certain price. Stop-loss orders can be used for forex, stock market trading, and securities blogger.comted Reading Time: 8 mins 5/21/ · Most newbies just trade with way too much lot size in relation to account size so will put a stop about 20 pips from the entry and 90% of the time the market will eat your stops. Entries need room to breathe in the forex market, a lot of room so stops need to be at

No comments:

Post a Comment