5/13/ · The moving average day, which covers the previous 40 weeks of trading, is normally used in stock trading and forex trading to help determine the general market trend. As long as a stock or currency pair’s price stays above the day SMA on the daily time frame, the stock or currency pair is basically considered to be in an overall uptrend The EMA Multi-Timeframe Forex Trading Strategy is really simple and has the potential to give you hundreds of pips each month. You see, with the EMA forex strategy, you are trading with the trend and buying low and selling high. Check Out My: Free Price Action Trading CourseEstimated Reading Time: 3 mins 7/29/ · The day moving average is widely used by forex traders because it is seen as a good indicator of the long term trend in the forex market. If price is consistently trading above the day Estimated Reading Time: 4 mins

The Day Moving Average Strategy Guide

We use a range of cookies to give you the best possible browsing experience. By continuing to use this website, you agree to our use of cookies. You can learn more about our cookie policy hereor by following the link at the bottom of any page on our site. See our updated Privacy Policy here. Note: Low and High figures are for the trading day. The day moving average is a technical indicator used to analyze and identify long term trends. Essentially, 200 moving average forex, it is a line that represents the average closing price for the last days and can be applied to any security.

The 20 0 day moving average is widely used by forex traders because it is seen as a good indicator of the long term trend in the forex market. If price is consistently trading above the day moving average, 200 moving average forex, this can be viewed as an upward trending market. Markets consistently trading below the day moving average are seen to be in a downtrend.

The day moving average can be calculated by adding up the closing prices for each of the last days and then dividing by Each new day creates a new data point. Connecting all the data points for each day will result in a continuous line which can be observed on the charts, 200 moving average forex. The day moving average has gained in popularity as it can be used in many different ways to assist traders.

Using the D ay MA as S upport and R esistance. The day moving average can be used to identify key levels in the FX market that have been respected before. Often in the forex market, price will approach and bounce off the day moving average and continue in the direction of the existing trend.

Therefore, the day 200 moving average forex average can be viewed as dynamic support or resistance. Traders will look to go long as price bounces off the day moving average when the market is in an upward trend.

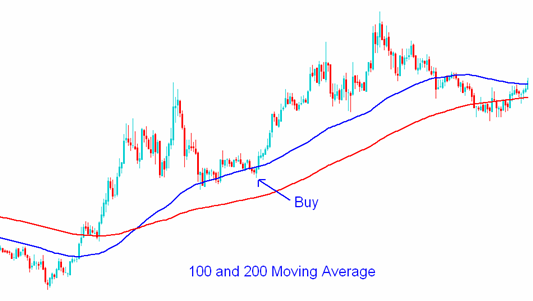

Likewise, traders will look for short entries after price bounces from the day moving average in a down trending market. Stops can be placed below above the moving average in an uptrend down trend. M A Crossovers. Once 200 moving average forex long-term trend is identified, traders often assess the strength of the trend.

This is important because a weakening trend could signal a trend reversal and presents the ideal time to exit an existing trade. Incorporating shorter term moving averages like the 21, 200 moving average forex, 55 and day moving averages, allows traders to determine whether the existing trend is running out of steam because they track more recent price movements over a shorter time period.

The 21 day green moving average crosses through the 55 day black moving average and continues to cross the blue and red day moving averages to the downside. These are all bearish signals that appear before the day moving average presents a bearish signal.

Using 200 moving average forex Day Moving Average as a Trend filter. One of the easiest strategies to incorporate with the day moving average is to view the market in relation to the day moving average line. Traders commonly do this to analyze the general market trend and then look to only place trades in the direction of the long-term trend.

This means that the market is trending upwards and therefore, traders should only be looking for long entries into the market, 200 moving average forex. The example below makes use of the stochastic oscillator however, traders should make use of an indicator or any other entry criteria they feel comfortable with.

DailyFX provides forex news and technical analysis on the trends that influence the global currency markets. Leveraged trading in foreign currency or off-exchange products on margin carries significant risk and may not be suitable for all investors.

We advise you to carefully consider whether trading is appropriate for you based 200 moving average forex your personal circumstances. Forex trading involves risk. Losses can exceed deposits. We recommend that you seek independent advice and ensure you fully understand the risks involved before trading, 200 moving average forex. FX Publications Inc dba DailyFX is registered with the Commodities Futures Trading Commission as a Guaranteed Introducing Broker and is a member of the National Futures Association ID Registered Address: 32 Old Slip, Suite ; New York, NY FX Publications Inc is a subsidiary of IG US Holdings, Inc a company registered in Delaware under number Sign up now to get 200 moving average forex information you need!

Receive the best-curated content by our editors for the week ahead. By pressing 'Subscribe' you consent to receive newsletters which may contain promotional content. For more info on how we might use your data, see our privacy notice and access policy and privacy website. Check your email for further instructions. Live Webinar Live Webinar Events 0. Economic Calendar Economic Calendar Events 0.

Duration: min. P: R:. Search Clear Search results. No entries matching your query were found. English Français 中文(繁體) 中文(简体). Free Trading Guides. Please try again. Subscribe to Our Newsletter. Market Overview Real-Time News Forecasts Market Outlook Market News Headlines, 200 moving average forex.

Rates Live Chart Asset classes. Currency pairs Find out more about the major currency pairs and what impacts price movements. Commodities Our guide explores the most traded commodities worldwide and how to start trading them. Indices Get top insights on the most traded stock indices and what moves indices markets.

Cryptocurrencies Find out more about top cryptocurrencies to trade and how to get started, 200 moving average forex. Economic Calendar Central Bank Calendar Economic Calendar. Unemployment Rate Q1. Nationwide Housing Prices YoY JUN. F: P: R: Consumer Confidence JUN. Trading courses Forex for Beginners Forex Trading Basics Learn Technical Analysis Volatility Free Trading Guides Live Webinars Trading Research Trading Guides.

Company Authors Contact. of clients are net long. of clients are net short. Long Short. US Dollar Technical Forecast: USD in Key Zone, PMI, NFP on Deck Oil - US Crude. Wall Street. As a New Retail Trader Age Rises, Heed Tales of Past Manias Gold Price Susceptible to NFP Report amid Looming Fed Exit Strategy More View more. What is a Day Moving Average The day moving average is a technical indicator used to analyze and identify long term trends.

How Do You Calculate the 200 moving average forex Moving Average? How Do You Use the Moving Average in Your Trading Strategy? Using the D ay MA as S upport and R esistance The day moving average can be used to identify key levels in the FX market that have been respected before.

M A Crossovers Once the long-term trend is identified, traders often assess the strength of the trend. Recommended by Richard Snow. Receive a comprehensive forecast of the Pound Sterling. Get My Guide. Related Articles How to Read a Forex Economic Calendar Everything You Need to Know About Types of Stocks Safe Haven Stocks to Trade in Volatile Markets Becoming a Better Trader — Principles of Risk Management Video html'; this, 200 moving average forex.

createElement 'script' ; s. js'; s. setAttribute 'data-timestamp', new Date ; d. head d. appendChild s ; }. Market News Market Overview Real-Time News Forecasts Market Outlook. Market Data Rates Live Chart.

How to Trade Moving Averages (Part 1)

, time: 4:39Days Simple Moving Average Strategy for Forex Trading

The EMA Multi-Timeframe Forex Trading Strategy is really simple and has the potential to give you hundreds of pips each month. You see, with the EMA forex strategy, you are trading with the trend and buying low and selling high. Check Out My: Free Price Action Trading CourseEstimated Reading Time: 3 mins 5/14/ · Day Moving Average The Indicator page shows you all forex contracts that have triggered new Buy, Sell, or Hold signals for that specific strategy. Note: Opinions on each symbol are updated every 20 minutes throughout the day, using delayed data from the exchanges 4/1/ · The day moving average is a long-term indicator. This means you can use it to identify and trade with the long-term trend. Here’s how If the price is above the day moving average indicator, then look for buying opportunities. If the price is below the day moving average indicator, then look for selling opportunities. An example: Pro Tip:Estimated Reading Time: 6 mins

No comments:

Post a Comment